Why Intrinsic Assets?

“The intrinsic value can be defined simply. It is the discounted value of the cash that can be taken out of a business during its remaining life. As our definition suggests, intrinsic value is an estimate rather than a price figure”

Warren Buffet

Intrinsic Value

Intrinsic value is the true value of an asset. Many companies are undervalued and the market price does not reflect the intrinsic value of the company.

How is intrinsic value calculated? The true value of an asset is determined by its ability to generate cashflows into the future. In a competitive industry, this cashflow may be determined by the ability of a company to maintain its competitive advantage and continue to build value.

Tangible assets such as land, buildings, plant and equipment depreciate and are incapable of sustaining competitive advantage. Any physical asset bought can be replicated by a competitor applying capital to buy a like asset.

Intrinsic assets are more likely to provide a unique and sustainable advantage. These are the assets that drive value into the future and provide the company with intrinsic value.

Such assets are often misunderstood or undervalued. Investment in intrinsic assets generally will not appear on the balance sheet and may not be generating full profit for the company. This leads to an undervaluing of the company by the market that often looks at historical financial performance, not the growth or future revenues that intrinsic assets may generate.

This difference is the reason the intrinsic value of a company or its assets may not be fully understood.

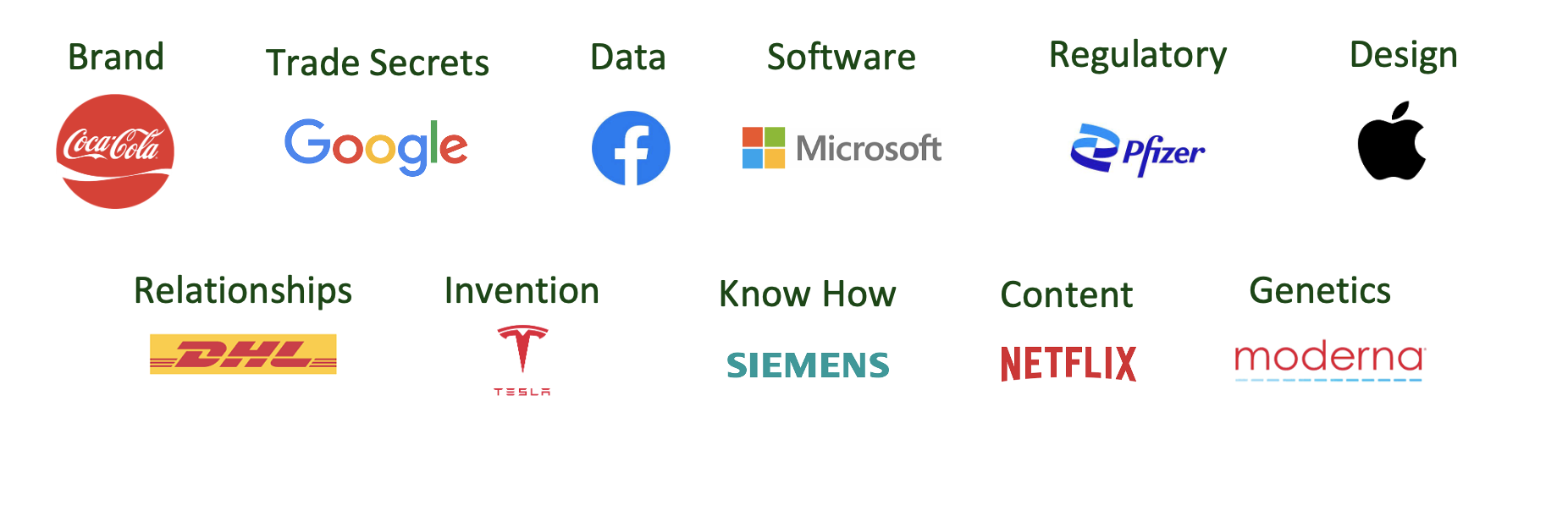

Intrinsic Assets come in many forms, including: